Bo Hines' decision to exit his prominent role leading Trump's digital assets council was a calculated move, paving the way for new leadership and his transition to spearhead Tether USA's stablecoin initiatives.

It’s often said that timing is everything, and for Bo Hines, stepping down as the head of former President Donald Trump’s digital assets council felt like the absolute right moment. Leaving such a high-profile position, especially one shaping the very future of digital assets in the United States, isn't something anyone takes lightly. Hines himself admitted it "certainly was difficult," a sentiment many can appreciate when making a significant career pivot. But what was behind this strategic shift, and where did this 30-year-old policy powerhouse head next?

The Strategic Departure: Why Bo Hines Left the White House

So, Hines' resignation, announced on August 9, wasn't just some impulsive decision. It came hot on the heels of a monumental achievement: the release of the 180-day report on digital assets by Trump’s digital asset council. This wasn't just another government document; it was, as Hines described it, "the most comprehensive report that’s ever been produced" concerning a regulatory framework for crypto in the US.

Laying the Groundwork for Crypto's Future

Imagine building the foundational architecture for an entirely new economic landscape. That's essentially what Hines and his team had been doing. Their mandate was clear: position the United States to become the undisputed "crypto capital of the world." With this extensive report, which laid out crucial policy recommendations, Hines felt they had firmly established the necessary groundwork. We're talking about everything from market structure and jurisdictional oversight to banking regulations, promoting the US dollar's global standing through stablecoins, and even taxation of cryptocurrencies. It’s like setting the initial blueprint for a towering skyscraper – once the design is solid, the next phase can begin.

Passing the Torch: A Fresh Voice for New Battles

What's interesting is that Hines' departure wasn't about him abandoning the mission. Quite the opposite, actually. His resignation created a clear path for his deputy, Patrick Witt, to take the reins. Why is this important? Well, as Hines explained, going into a fresh round of legislative battles – like the ongoing digital asset market structure bill currently moving through the Senate – often benefits from a new perspective, a "fresh voice in the room." It’s a strategic play, ensuring that the council had renewed energy and leadership for the challenges ahead, and Hines genuinely wanted Witt to have that opportunity.

Not only that, but Hines' move also came just a couple of weeks after President Trump signed the GENIUS Act into law. This significant stablecoin legislation was something Hines himself played a pivotal role in crafting. He felt an "immense opportunity" calling him back to the private sector, specifically to help realize the Genius Act's vision: attracting the brightest and most innovative minds in the crypto space to the US. His focus was shifting from policy creation to actively "building something," a prospect that clearly energized him.

Embracing the Private Sector: A New Chapter with Tether USA

Leaving a top government role is bound to turn heads, especially in a rapidly evolving sector like crypto. Hines wasn't just looking for any job; he was seeking a chance to innovate, to construct, to push boundaries. "Really, what I was looking for was an opportunity to build something. I mean, that’s what excites me," he shared.

From Policy to Building: The Allure of Innovation

And build he did. Within days of his resignation, the opportunities flooded in. Hines explicitly stated he hadn't been in discussions with companies before stepping down, which makes the sheer volume of interest even more impressive. Over 50 job offers poured in, a testament to the influence and prominence of his former position. It's only natural that a figure who just helped architect the future of US crypto regulation would be highly sought after by companies operating within that very ecosystem.

Leading the Stablecoin Revolution with Tether USA

The next chapter of his career quickly materialized. On August 19, Hines was appointed CEO of Tether USA. This wasn't just any role; it put him at the forefront of Tether's mission to integrate stablecoins into the mainstream financial world. When asked about his new role, his enthusiasm was palpable. "There’s no better place to build," he asserted, pointing out that Tether accounts for an astonishing "over half of all transaction settlements in the crypto ecosystem on a daily basis."

At Tether, Hines isn't just settling in; he's already pushing forward with ambitious plans for USAT, a new US-based stablecoin. This isn't just another digital dollar; Hines believes it's poised to become the first federally licensed stablecoin product in the United States. If that holds true, it would grant Tether a truly "unique first mover’s advantage," potentially reshaping the stablecoin landscape.

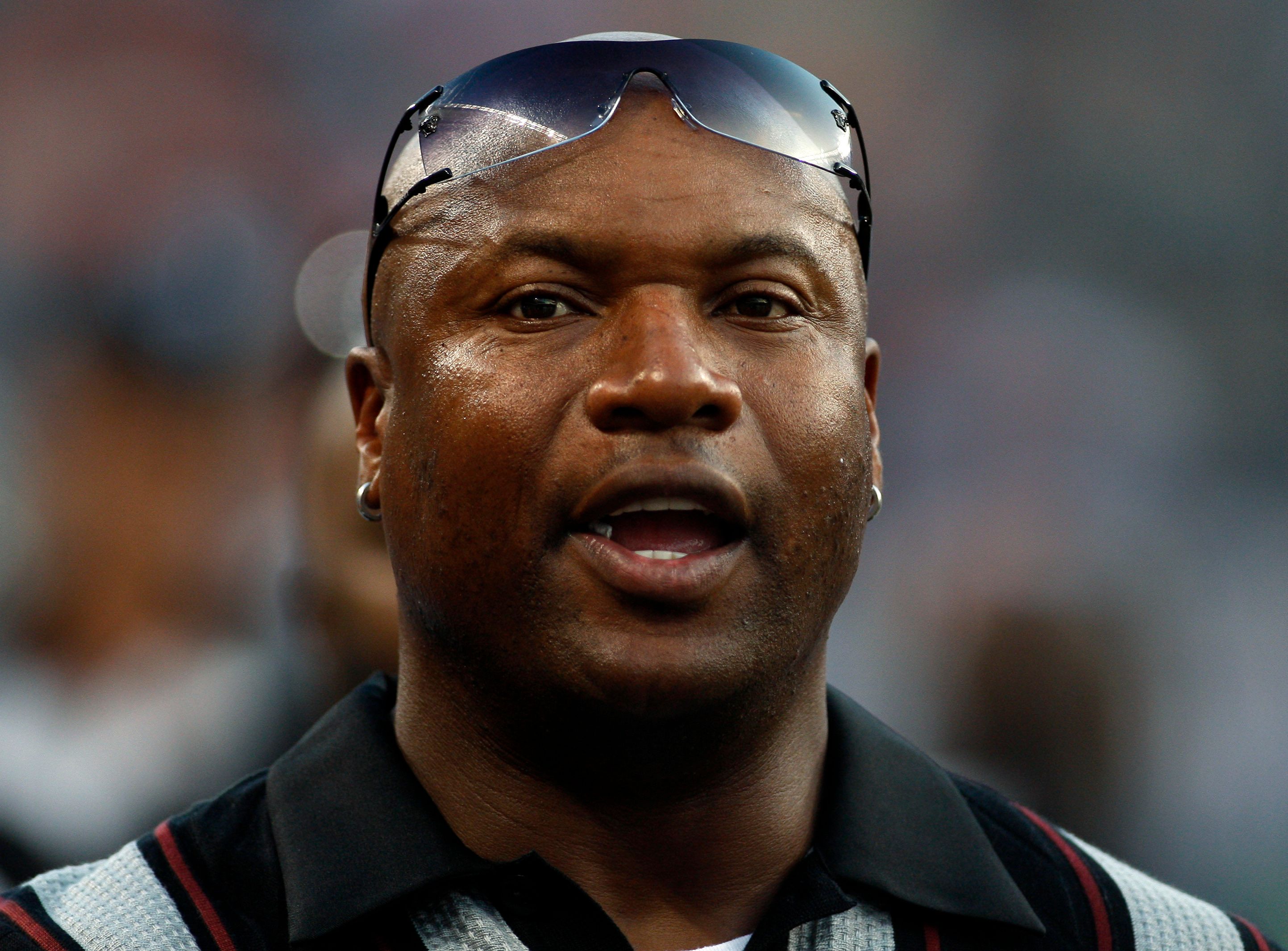

Who is Bo Hines? A Journey from Football Fields to Digital Frontiers

It’s easy to look at Bo Hines and see someone thrust into immense responsibility at a remarkably young age. At just 30, leading a key government council and then a major crypto firm might seem like a meteoric rise. But Hines suggests this journey has been a long time coming. "I had been engaging with this space from the time I was 18 years old," he revealed, indicating a decade of immersion in the digital asset world before his prominent public roles.

An Early Start in the Digital Asset Space

Born and raised in North Carolina, Hines was a standout from early on. He attended North Carolina State University, where he excelled as a wide receiver for the NC State Wolfpack college football team. He wasn’t just a name on a roster; he garnered significant hype throughout his college football career, signaling a natural talent for demanding fields.

The Unexpected Path: From Athletics to Public Service

The trajectory seemed set for a sports career, especially when significant excitement surrounded his transfer to the prestigious Yale University in January 2015. However, life, as it often does, had other plans. A series of unfortunate, season-ending shoulder injuries shifted his focus. It was a difficult pivot, but one he openly attributed to a higher calling, sensing it was time to move in a different direction. This unexpected turn led him to his true passion: politics. That same year, following his athletic career's end, he announced his first congressional run, embarking on a path that would eventually lead him to the heart of digital asset policy.

The Future of Crypto: Bitcoin Reserves and a Trillion-Dollar Vision

It's nearly impossible to chat with Hines without touching upon one of the most talked-about topics in the digital asset space: the progress of the US Strategic Bitcoin Reserve. This isn't just a casual interest for him; it's a conviction.

Confidence in the US Strategic Bitcoin Reserve

While still serving in the White House back in July, Hines firmly stated, "We do believe in accumulation," a stance he maintains to this day. He holds no reservations that the US Strategic Bitcoin Reserve is destined to move forward. He points to the executive order signed by President Trump in March, establishing the framework, as concrete evidence of this progress. Ultimately, the desire is to see Congress enshrine this initiative into law, ensuring its lasting and meaningful impact on the nation's financial future.

Currently, the US government already holds a substantial amount of Bitcoin – approximately 198,012 BTC, seized primarily from criminal cases. However, they haven't yet started buying any. This delay has sparked debate, with some prominent Bitcoin advocates suggesting that the US risks being "front-run" by other nations if it doesn't accelerate its accumulation strategy. But here's an interesting counterpoint: some research indicates a strong likelihood that the US government will establish this much-anticipated Strategic Bitcoin Reserve by the end of the current year. While Hines couldn't offer a specific timeline, he expressed strong confidence in the current leadership, particularly praising David Sacks, the White House’s crypto and AI czar, for his swift and decisive approach to the digital asset strategy.

A Vision for Instant Settlements and Tokenized Securities

Looking beyond the reserve, Hines paints a vibrant picture of the future. He envisions a world with 24/7 markets, where payments settle instantly, and public securities are tokenized, allowing for trading without traditional intermediaries. "You’re going to see tokenized public securities start to happen very quickly," he predicts, adding that this shift will bring unprecedented "market efficiency" and "commodity exchange efficiency." His core belief? "Everything moves onchain."

The scale of this transformation, he believes, will be massive. Referencing a past statement by Secretary Bessent, who anticipated the stablecoin industry exceeding a trillion-dollar market cap in the coming years, Hines agrees. But he goes further, suggesting, "I think that as tokenization continues to occur, it can be much greater than that." He also holds a strong conviction that the rest of the world will ultimately align with the regulatory frameworks established by the United States, positioning the US as a global leader in this digital evolution.

FAQ

-

Why did Bo Hines leave Trump's digital assets council? Bo Hines left his role after the council released a comprehensive 180-day report on digital assets, feeling that the groundwork for US crypto regulation was well established. He also aimed to create an opportunity for his deputy, Patrick Witt, to bring a "fresh voice" to upcoming legislative battles, and sought an "immense opportunity" to build within the private sector, particularly in stablecoin innovation.

-

What is Bo Hines' current role at Tether USA? Bo Hines is currently the CEO of Tether USA, where he oversees the company's efforts to integrate stablecoins into the mainstream financial system. He is actively involved in pushing forward with USAT, a new US-based stablecoin that he anticipates will be the first federally licensed stablecoin product in the US.

-

What is the significance of the US Strategic Bitcoin Reserve? The US Strategic Bitcoin Reserve is an initiative to accumulate Bitcoin as a strategic asset for the nation. It was established via an executive order by President Trump in March, and while the US government currently holds a significant amount of seized Bitcoin, it has yet to begin actively buying more. Its significance lies in securing the US's position in the global digital economy and potentially mitigating risks associated with traditional financial systems.

Conclusion

So, there you have it – the story of Bo Hines, a young leader whose strategic moves are making waves in both political and crypto circles. His departure from the White House wasn't an exit from the mission, but rather a calculated pivot, designed to ensure continued progress in US crypto policy while allowing him to pursue his passion for "building" in the private sector. Now at the helm of Tether USA, he's driving innovation in the stablecoin space, with a vision that encompasses much more than just digital currencies – thinking about 24/7 markets, instant settlements, and tokenized securities. It’s clear that whether in public service or the private sector, Hines is committed to shaping the future of digital assets, believing the US is poised to lead the world into this new economic frontier.