Imagine making a decision that feels right, even when it’s incredibly tough. That's exactly what Bo Hines faced when he stepped down from his pivotal role leading US President Donald Trump's digital assets council, opening a new chapter at Tether USA.

Stepping Away from the White House: A Calculated Move

It really wasn't an easy call, you know? Bo Hines, who was just 30 at the time, openly shared during a candid chat at Korea Blockchain Week that leaving his post as the head of the digital assets council was "certainly difficult." But despite the challenge, he genuinely felt it was "the right time" to move on. He had a clear vision, explaining that the team had successfully "positioned the United States to be the crypto capital of the world," which was precisely what President Trump had tasked them with doing.

Now, his resignation, which happened on August 9th, came hot on the heels of the council releasing its extensive 180-day report on digital assets. The timing was crucial here; it gave Hines a sense of accomplishment, believing that the foundational work, the guidelines, and the overarching framework for the US crypto industry were firmly in place and heading in the right direction. This confidence cleared his path to start exploring fresh opportunities back in the private sector.

The Groundbreaking Digital Assets Report

So, what made this report so special? Hines described it as "the most comprehensive report that’s ever been produced," especially when you consider its focus on regulatory frameworks. It truly set out to provide clear guidance on what the administration envisioned for market structure in the crypto space.

What exactly did this landmark report cover? Well, it laid out some pretty crucial policy recommendations aimed at shaping how crypto would be regulated in the US. These included vital aspects such as:

- Establishing a robust crypto market structure.

- Defining clear jurisdictional oversight for various digital assets.

- Implementing appropriate banking regulations for the crypto sector.

- Strategically promoting US dollar hegemony through the careful integration of stablecoins.

- And, of course, addressing the complex issue of cryptocurrency taxation.

It sounds like a lot, doesn't it? But Hines and his team clearly put in the work to lay a solid foundation.

Passing the Torch: A Fresh Voice for Future Battles

Hines’ departure wasn’t just about him moving on; it also created a fantastic opportunity for his deputy, Patrick Witt, to step into the leadership role. Hines thought this was a brilliant move, providing the council with a "fresh leading voice" as it prepared to tackle even more intricate crypto legislation. Think about bills like the digital asset market structure bill, which is currently making its way through the Senate—it's complex stuff!

He truly wanted to ensure that Patrick was "afforded that opportunity," emphasizing that going into new rounds of legislative battles, it’s always beneficial to have someone with fresh perspective in the room.

Not only that, but Hines’ resignation also occurred just two weeks after President Trump signed the GENIUS Act into law. This was a significant piece of stablecoin legislation, and Hines played an absolutely critical role in its crafting. He saw an "immense opportunity" to shift back to the private side and actually work on delivering what the GENIUS Act aimed to achieve. What was that, you ask? To "bring the brightest and most foremost innovators in the space to the US." Hines put it simply: "Really, what I was looking for was an opportunity to build something. I mean, that’s what excites me."

A Swift, But Organic, Transition to Tether USA

You can imagine that someone in such a high-profile position would attract a lot of attention, right? Well, Hines wasn't looking before he leaped, but opportunities certainly came knocking. He shared that within mere days of stepping down, he had received well over 50 job offers. He made it very clear that he hadn't engaged in any discussions with companies before his resignation, which speaks volumes about his integrity. Still, given his prominent role, it was completely natural that his departure sparked immense interest from crypto companies eager to bring his expertise onboard.

And just ten days later, on August 19th, the news broke: he was appointed CEO of Tether USA. In this new role, he's now overseeing Tether's ambitious efforts to integrate stablecoins into the financial mainstream. Why Tether? He sees it as an unparalleled place to "build," highlighting its massive influence in the crypto ecosystem, where it accounts for "over half of all transaction settlements on a daily basis."

At Tether, Hines is already making waves, driving forward the new US-based stablecoin, USAT. He envisions this as potentially the first federally licensed stablecoin product in the US, giving Tether a "unique first mover’s advantage" in a rapidly evolving market.

Beyond the Résumé: Who Exactly is Bo Hines?

It might seem like a tremendous amount of responsibility for someone who's just barely hit 30, but Hines insists he’s been gearing up for this moment his entire adult life. "I had been engaging with this space from the time I was 18 years old," he explained.

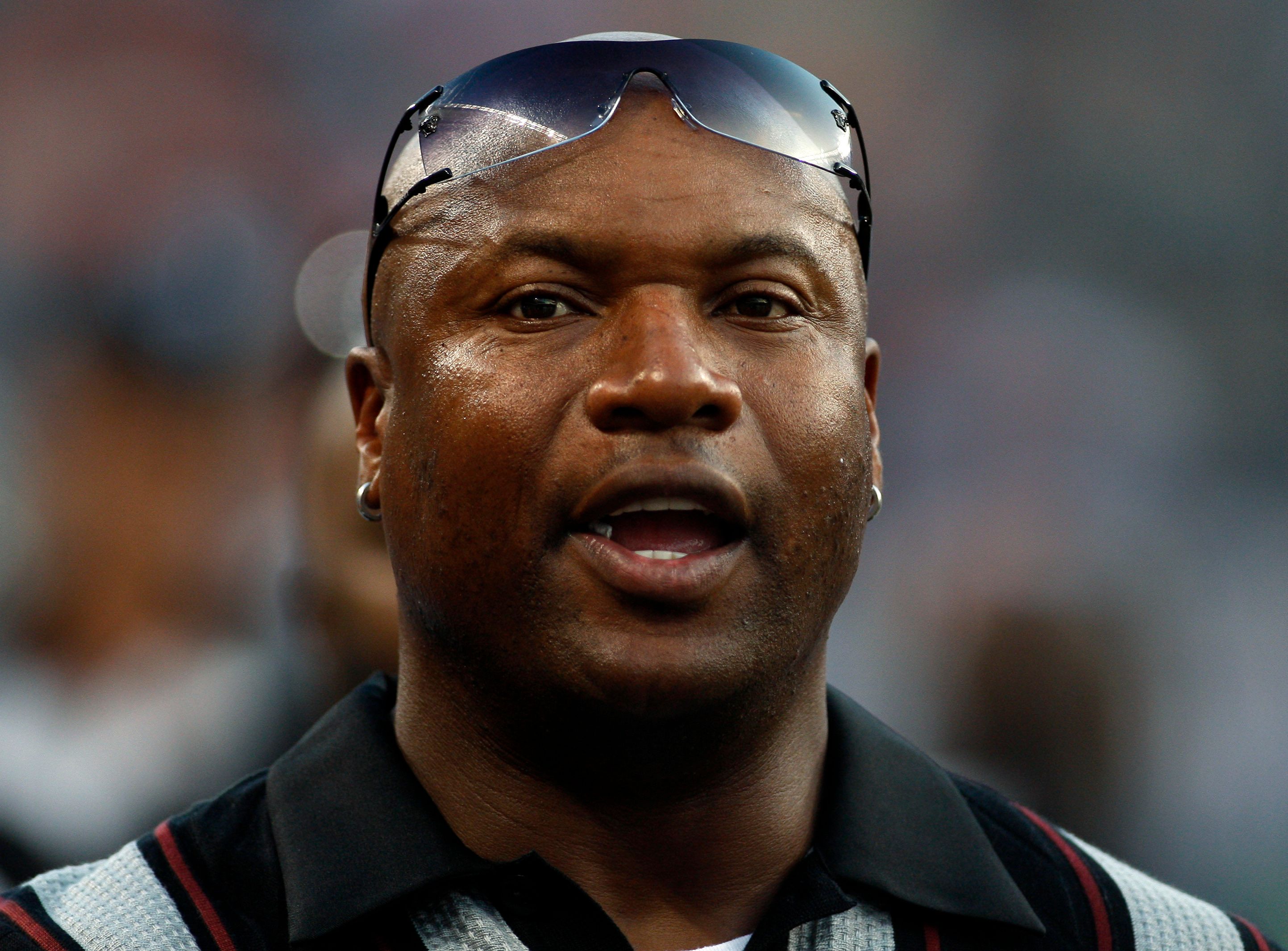

Hines has always been the kind of person who stands out. Born and raised in North Carolina, he went on to attend North Carolina State University, where he excelled as a wide receiver for the NC State Wolfpack football team. He wasn't just a benchwarmer; he carried significant buzz throughout his college football career. By January 2015, there was considerable excitement surrounding his transfer to the prestigious Yale University, where he continued to play.

However, a series of unfortunate injuries ultimately led him down a different path. After suffering two season-ending shoulder injuries back-to-back, he felt it was a clear sign from a higher power to move in another direction. That new direction? Politics. He announced his first congressional run in 2021, marking a significant pivot from the gridiron to the political arena.

The Future of US Crypto: Strategic Bitcoin Reserve and Beyond

It's pretty hard to sit down with Bo Hines and not bring up the elephant in the room: the progress on the US Strategic Bitcoin Reserve. Back in July, while still serving in the White House, Hines publicly stated, "We do believe in accumulation," a conviction he still holds strongly today.

He has absolute confidence that the US Strategic Bitcoin Reserve will continue to move forward as planned. "It’s been established," he confirmed, referring to the executive order that President Trump signed back in March. While the executive order is a crucial first step, Hines also expressed a desire to see Congress "enshrined into law," assuming it creates the lasting and meaningful impact that everyone involved hopes for.

It's fascinating to consider that the US government already holds a substantial amount of Bitcoin—around 198,012 BTC, to be exact—all seized from various criminal cases. But they haven't actually started buying any yet. This delay has sparked some debate; for instance, Bitcoin advocates like Jan3 founder Samson Mow argue that if the US doesn't act quickly, other nations might get ahead. On the flip side, industry experts like Alex Thorn, head of firm-wide research at Galaxy Digital, recently suggested there's a strong likelihood the US government will establish this much-anticipated Strategic Bitcoin Reserve by the end of this year.

Hines didn't offer a specific timeline for when that might happen, but he clearly voiced his confidence in the current leadership, particularly praising David Sacks, the White House’s crypto and AI czar. He noted that when David stepped in, they "really hit it off" and quickly began devising what they felt was the "right formula for success," adding that Sacks was "very keen on moving quickly."

Bo Hines' Grand Vision for a Tokenized Future

Looking ahead, Hines has a truly ambitious vision for the future of finance and technology. He envisions a world with 24/7 markets, where payments settle instantly, and public securities are tokenized, allowing them to be traded without the need for traditional intermediaries.

"You’re going to see tokenized public securities start to happen very quickly," he predicted, emphasizing that this shift will usher in greater "market efficiency" and "commodity exchange efficiency." His core belief? "Everything moves onchain."

Hines believes the scale of this transformation could be absolutely massive. He referenced Secretary Bessent, who suggested that the stablecoin industry alone could reach over a trillion dollars in market cap within the next few years. Hines agrees with this assessment, but then takes it a step further: "I think that as tokenization continues to occur, it can be much greater than that." He’s also optimistic that, in time, the rest of the world will inevitably follow the regulatory path set by the United States. "You’ll start to see other regulatory frameworks around the world start to match what we did," he stated confidently.

FAQ

Q1: What was Bo Hines' main reason for leaving Trump's digital assets council? A1: Bo Hines felt it was the right time to transition back to the private sector after establishing a comprehensive regulatory framework and positioning the US as a leader in crypto. He was also eager to "build something" based on the foundational work laid by the council.

Q2: What is the USAT stablecoin that Bo Hines is working on at Tether USA? A2: USAT is a new US-based stablecoin that Bo Hines is pushing to become the first federally licensed stablecoin product in the US, aiming to give Tether a significant first-mover advantage in the regulated market.

Q3: What is Bo Hines' long-term vision for the crypto market? A3: He envisions a future with 24/7 markets, instant settlement for payments, and tokenized public securities traded without intermediaries. He believes "everything moves onchain" and that the stablecoin industry, driven by tokenization, could surpass a trillion-dollar market cap.

Closing Thoughts

Bo Hines' journey from a prominent role in the White House to leading Tether USA is a fascinating one, showcasing a deep commitment to the digital asset space. His decision to leave a high-profile government position wasn't taken lightly, but it was driven by a strong belief that the groundwork for a robust US crypto industry had been laid, and a personal desire to build and innovate in the private sector. Now, at Tether, he's not just continuing to advocate for stablecoins but actively shaping their future, pushing for innovation and regulatory clarity. It's clear that whether in government or the private sector, Hines is determined to leave a significant mark on the evolving world of digital assets.