Leaving Donald Trump's digital assets council was a tough call for Bo Hines, the visionary leader now steering Tether USA. He recently opened up about this pivotal career move, his impact on U.S. crypto policy, and his bold plans for stablecoins and tokenized assets, aiming to reshape the financial landscape.

A Pivotal Departure from Public Service

Stepping away from such a high-profile position, especially as the head of former President Trump's digital assets council, is never a decision taken lightly. And for Bo Hines, it certainly wasn't. He candidly expressed how difficult it was to leave, yet felt that the timing was absolutely right for his next chapter. Why the sense of perfect timing? Well, he believed the team had successfully positioned the United States to become the undisputed crypto capital of the world, a direct mandate from the president himself. Mission accomplished, or at least the critical groundwork laid!

Now, this significant transition on August 9th wasn't arbitrary. It came hot on the heels of the digital asset council's much-anticipated 180-day report on digital assets. For Hines, the release of this comprehensive document meant that the foundational guidelines and framework for the U.S. crypto industry were firmly in place and headed in the right direction. With that achievement under his belt, his gaze turned towards the exciting opportunities waiting for him back in the private sector.

Laying the Groundwork: The Digital Assets Report

So, what exactly made this report such a game-changer? Hines himself describes it as the most extensive and thorough regulatory framework ever produced for the digital asset space, offering crucial guidance on what the administration envisioned for market structure. It was designed to provide clarity and direction, which, let's be honest, is something the crypto world desperately craves.

The report wasn't just a general overview; it delved into concrete policy recommendations crucial for effectively regulating crypto in the United States. These included vital areas such as:

- Establishing a clear crypto market structure.

- Defining jurisdictional oversight to prevent regulatory confusion.

- Modernizing banking regulations to accommodate digital assets.

- Promoting the continued dominance of the U.S. dollar through innovative stablecoins.

- Crafting fair and effective taxation policies for cryptocurrencies.

This wasn't just a theoretical exercise; it was a blueprint for how America could lead the charge in the global digital economy.

Passing the Torch and Pursuing New Horizons

Hines’ departure also smoothed the path for his deputy, Patrick Witt, to seamlessly take the helm. Hines felt strongly that a fresh voice would be incredibly beneficial for the council as it prepared to tackle a new round of legislative challenges. Think about it: a new leader often brings renewed energy and perspective, especially as crucial crypto legislation, like the digital asset market structure bill, navigates its way through the Senate. Ensuring Witt had this opportunity was clearly important to Hines, showcasing a thoughtful transition of leadership.

What’s interesting is that this move also happened only two weeks after former President Trump signed the GENIUS Act into law, a significant piece of stablecoin legislation that Hines played a pivotal role in shaping. For Hines, this timing wasn't just a coincidence; it represented an immense opportunity. He felt a deep pull to move back to the private side to actively work on making the GENIUS Act's core vision a reality – that is, attracting the brightest and most innovative minds in the blockchain space to the United States. He wasn't just looking for another job; he was looking for a chance to build something. And honestly, who can't relate to that passion for creation and impact?

A New Chapter: Leading Tether USA

Talk about hitting the ground running! Once Hines stepped down, opportunities truly flooded in. He mentioned that within just a few days of his resignation, he had already received well over 50 job offers. And to be clear, he emphasized that there were no prior discussions with any companies before his departure. But, given the prominence of his role within the White House, it was only natural that his exit would pique serious interest from crypto companies eager to tap into his expertise.

Fast forward to August 19th, and the news broke: Bo Hines was appointed CEO of Tether USA. This wasn't just another job; it was a direct alignment with his vision to bring stablecoins into the mainstream of the financial world. When you consider Tether's massive footprint – accounting for over half of all daily transaction settlements in the crypto ecosystem – it’s easy to see why Hines saw it as an unparalleled place to build and innovate. It’s like being handed the keys to a vast, active city and being told to make it even better.

At Tether, Hines is already making waves, driving forward the development of a new U.S.-based stablecoin called USAT. What makes this particularly exciting is his assertion that USAT is poised to become the first federally licensed stablecoin product in the country. If this comes to fruition, it would undeniably give Tether a significant first-mover advantage, solidifying its position as a major player in the evolving landscape of digital finance. Imagine being the first to introduce a trusted, regulated product in a burgeoning market – that's a game-changer.

Beyond Politics: Who is Bo Hines?

It might seem like a lot for someone who's just barely turned 30, taking on such immense responsibility. But Hines will tell you he's been preparing for this moment his entire life, engaging with the crypto space since he was just 18 years old. This isn't some overnight success story; it's a journey rooted in long-term passion and dedication.

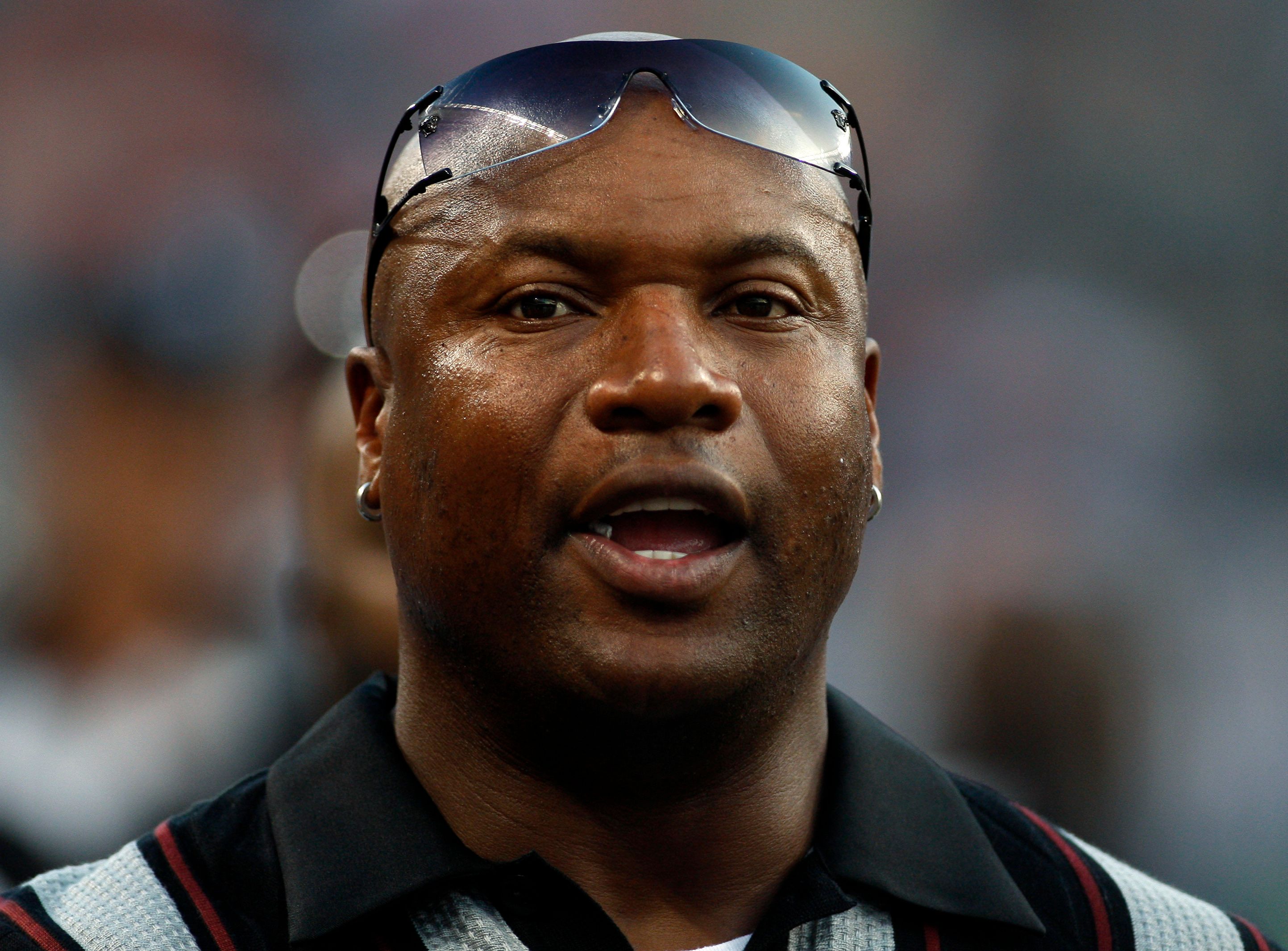

Born and raised in North Carolina, Hines has always been a standout achiever. He attended North Carolina State University, where he excelled on the football field as a wide receiver for the NC State Wolfpack. He wasn't just another player; he arrived with significant hype and continued to be a notable figure throughout his college football career.

By January 2015, the buzz intensified around his transfer to the prestigious Yale University. He continued his football journey there, but as fate would have it, a series of unfortunate injuries ultimately guided him toward a different path, leading him to his true calling: politics. He once shared in an interview how two back-to-back season-ending shoulder injuries felt like a divine redirection in his life. And so, in 2021, he officially announced his first congressional run, marking a new chapter in his already dynamic career.

The Strategic Bitcoin Reserve: Awaiting Its Moment

Now, we can't really talk to Hines about the future of digital assets without addressing the elephant in the room: the progress, or perceived lack thereof, on the U.S. Strategic Bitcoin Reserve. Back in July, while still serving in the White House, Hines declared, "We do believe in accumulation." This isn't just a past sentiment; it's a view he firmly holds today.

Hines remains steadfastly confident that the U.S. Strategic Bitcoin Reserve will continue to advance as planned. He points to the executive order signed by Trump back in March as the foundational establishment of this initiative. While the executive order laid the groundwork, Hines clearly hopes to see Congress take the next step, enshrining the reserve into law. Why is this important? Because it would provide a lasting and meaningful impact, ensuring the initiative endures beyond any single administration.

Currently, the U.S. government already possesses approximately 198,012 Bitcoin, primarily seized from various criminal cases. However, it has yet to actually begin purchasing additional Bitcoin for a strategic reserve. This situation has sparked a lively debate within the crypto community. Some prominent Bitcoin advocates, like Jan3 founder Samson Mow, argue that if the U.S. doesn't accelerate its buying, other nations could "front-run" them, securing significant holdings first. On the flip side, Alex Thorn, head of firm-wide research at Galaxy Digital, has expressed a strong likelihood that the U.S. government will indeed establish this highly anticipated Strategic Bitcoin Reserve by the end of this year.

While Hines couldn't offer a specific timeline for when active buying might commence, he voiced strong confidence in the current leadership steering these efforts. He specifically praised David Sacks, the White House's crypto and AI czar, describing how they quickly "hit it off" and began devising what they felt was the "right formula for success," noting Sacks' keenness on moving swiftly. It sounds like the gears are definitely turning, even if the public timeline remains a bit blurry.

Envisioning Crypto's Future: Beyond Trillions

Bo Hines' vision for the future isn't just about stablecoins; it’s about a complete overhaul of traditional financial systems. He paints a picture of 24/7 markets, where payments settle instantly, and public securities are tokenized, allowing them to be traded without the need for traditional intermediaries. Imagine a world where transaction delays and costly middlemen are relics of the past – that's the future he's striving for.

"You're going to see tokenized public securities start to happen very quickly," he asserts, predicting a dramatic increase in market efficiency across the board, including commodity exchanges. His mantra is clear: "Everything moves onchain." This isn't just a technical shift; it's a fundamental reimagining of how value is exchanged and managed globally.

When we talk about the scale of this transformation, Hines believes it will be absolutely massive. He echoes Secretary Bessent's belief that the stablecoin industry alone will exceed a trillion dollars in market capitalization within the next few years. But Hines takes it a step further. He believes that as tokenization continues its relentless march forward, the potential for the stablecoin industry, and indeed the broader digital asset economy, to grow could be "much greater than that." It’s an exciting prospect, isn’t it? He also holds a firm conviction that the rest of the world will ultimately look to the United States as a regulatory trailblazer, eventually adopting similar frameworks. It seems America's role as a global leader in finance is set to continue, just in a much more decentralized, digital format.

FAQ Section

1. Why did Bo Hines leave his role with President Trump's digital assets council? Bo Hines felt it was the right time to transition after successfully laying the groundwork for the U.S. to become a global crypto leader, especially after the release of the comprehensive 180-day digital assets report. He sought new opportunities in the private sector where he could actively build within the crypto space.

2. What is the significance of Hines' new role as CEO of Tether USA? As CEO of Tether USA, Bo Hines is tasked with bringing stablecoins to the financial mainstream. He's also spearheading the development of USAT, which he envisions as the first federally licensed stablecoin in the U.S., potentially giving Tether a significant first-mover advantage and further integrating digital assets into traditional finance.

3. What is Hines' vision for the future of the crypto industry? Hines envisions a future with 24/7 markets, instant payment settlements, and tokenized public securities that can be traded without intermediaries. He believes "everything moves onchain," leading to massive market efficiency, and predicts the stablecoin industry's market cap will significantly surpass a trillion dollars as tokenization expands.

Conclusion

So, there you have it – the story of Bo Hines, a young leader whose journey from college football to the heart of U.S. crypto policy, and now to the helm of Tether USA, is nothing short of fascinating. His decision to leave Trump's digital assets council, while difficult, was clearly strategic, aiming to push the boundaries of digital finance in the private sector. We've seen how he played a crucial role in shaping key reports and legislation, and now he's focused on making stablecoins like USAT a mainstream reality. With his bold vision for a future where everything moves "onchain" and tokenized assets redefine market efficiency, it’s clear that Hines is not just following the trends, but actively shaping them. It'll be exciting to watch how his leadership continues to influence the ever-evolving world of cryptocurrency.